What the new Your Future, Your Super means for you

Recent legislative reforms to the superannuation arena are set to change the retirement savings landscape for many Australians.

The Federal Government says the Your Future, Your Super reforms will help ensure superannuation works in the best financial interests of all Australians by removing unnecessary waste, increasing accountability and transparency, and providing more flexibility for families and individuals.

The legislation increases the maximum number of allowable members in self-managed superannuation funds (SMSFs) and small APRA funds from four to six from 1 July 2021.

The reforms also extend the bringforward arrangements to people aged 65 and 66 for non-concessional contributions made on or after 1 July 2020. This change is on top of a previous reform that allowed people aged 65 and 66 to make contributions without meeting the work test.

The excess concessional contributions charge, which currently applies to contributions in excess of the concessional contributions cap, is to be removed from 1 July 2022, thereby ensuring people saving for their retirement are not financially disadvantaged by inadvertent breaches of the cap.

Australians will also be supported to make additional contributions to their superannuation to make up for amounts that they may have withdrawn due to COVID- 19. From the 2021-22 financial year, individuals who released superannuation under the COVID-19 early release scheme will have the option of recontributing these amounts as non-concessional contributions, over and above the existing caps.

Some of the key changes are:

■ Your superannuation fund will follow you. This will be achieved by preventing the creation of unintended multiple superannuation accounts when employees change jobs. This measure is set to commence from 1 November 2021.

■ Funds will be held to account for underperformance. In order to lower fees and protect members from poor outcomes, the reforms will require superannuation products to meet an annual objective performance test. Those that fail will be required to inform members, and persistently underperforming products will be prevented from taking on new members. Members will be notified by 1 October 2021 if their fund fails this test.

■ It will be easier to choose a fund. A “YourSuper” comparison tool will be based on information that superannuation funds report to APRA. The information about product performance will be updated quarterly to ensure people are making decisions using up-to-date information.

■ Transparency and accountability will be in focus. Treasury is to strengthen obligations to ensure trustees only act in the best financial interests of members and provide better information regarding how they manage and spend members’ money in advance of annual members’ meetings and through enhanced portfolio holdings disclosure.

Capital works deductions for rental property

Rental property investors can claim capital works deductions for construction costs for a rental property, however there are limits imposed in relation to the dates such works were completed. The deductions are only available on residential properties built after 17 July 1985. Generally, up to 15 September 1987 the rate is 4% a year (over 25 years) and after then it is 2.5% (but over 40 years).

Residential property investors seeking capital works deductions need to remember that they can only make a claim for periods when the rental property was used for income producing purposes, not when used for private purposes.

Subsequent purchasers of a property can claim for the balance of the period, because unlike a depreciating asset there is no balancing adjustment on disposal of the property, unless the building is destroyed. The balance of any claim is passed on, on the same basis, to any later owners.

The seller of a property is required by legislation to provide the buyer with the cost of construction of the original building and any structural improvements.

However, this does not always occur and there is no enforcement mechanism in the legislation. If it is not possible to determine the actual construction costs, it is allowable to obtain an estimate from a quantity surveyor or other independent qualified person. It is also permissible to claim a deduction for the cost of that estimate.

Capital works expenses incurred form part of the cost base of the property for capital gains tax purposes. If you claim a capital works deduction, this will need to be taken into account when working out a future capital gain or loss (more below).

Construction expenditure that can be claimed

Some costs that may be included in construction expenditure are:

■ preliminary expenses such as architects’ fees, engineering fees and the cost of foundation excavations

■ payments to carpenters, bricklayers and other tradespeople for construction of the building, and

■ payments for the construction of retaining walls, fences and in-ground swimming pools.

Construction expenditure that cannot be claimed

Some costs that are not included in construction expenditure are:

■ the cost of the land on which the rental property is built

■ expenditure on clearing the land prior to construction

■ earthworks that are permanent, can be economically maintained and are not integral to the installation or construction of a structure, and

■ expenditure on landscaping.

Required details

To make sure that you are eligible to make a capital works deduction claim, all of the following is required:

■ details of the type of construction

■ the date construction commenced

■ the date construction was completed

■ the construction cost (not the purchase price)

■ details of who carried out the construction work

■ details of the period during the year that the property was used for income producing purposes.

Adjustments to the CGT cost base

In calculating a capital gain or capital loss from a rental property, the cost base and reduced cost base of the property may need to be reduced to the extent that it includes construction expenditure that has been claimed or can be claimed as a capital works deduction.

However the ATO states that it will accept that a taxpayer cannot deduct an amount for construction expenditure in respect of a rental property if the taxpayer:

■ does not (as a question of fact) have sufficient information to determine the amount and nature of the expenditure, and

■ does not seek to deduct an amount in relation to the expenditure.

This means that in working out a capital gain or loss arising from a CGT event happening in relation to the rental property, the taxpayer is not required to reduce the asset’s cost base by the amount not deducted under the capital works deduction rules in relation to the asset.

Trust losses: Keeping them in the family

Who can (and can’t) be part a family group for the purpose of making a

family trust election (FTE)?

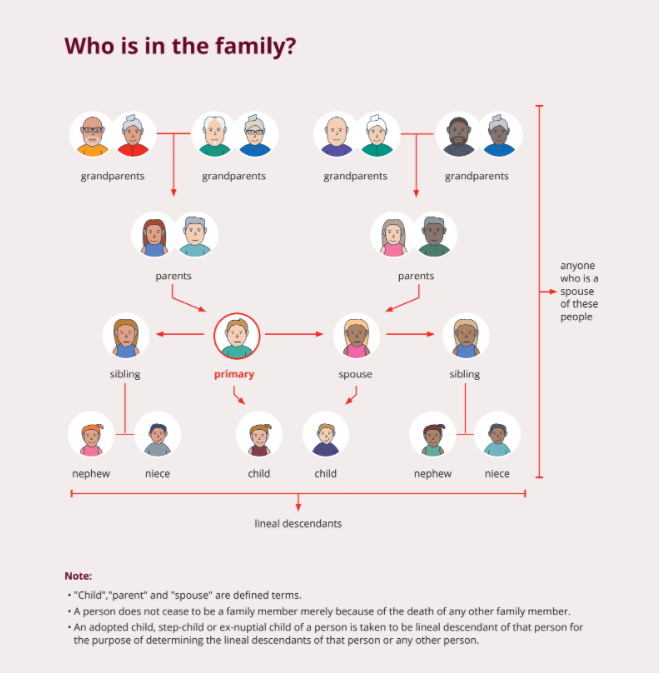

As you can see by the diagram on the following page, the ‘family group’ is dependent on the choice of the ‘test individual’. Once that person is chosen, the family group includes the person’s spouse, plus any of their children, grandchildren, parents, grand- parents, brothers, sisters, nephews, or nieces. The spouses of any of these people are also included.

The family group can include a de facto spouse, stepchildren and half-brothers and half-sisters, but not aunts and uncles, cousins, great-grandchildren, or stepbrothers and stepsisters. The spouse of a deceased test individual will continue as a member, but not if they partner up again. And where a married test individual is divorced, the family group membership of their former spouse is ended. However, the former spouse is still in the family group in relation to distributions.

Importantly, if the test individual dies, the trust remains a family trust and the family group continues to be worked out by reference to the test individual.

Where an FTE is made, the rules that limit the deductibility of prior year and current year losses and bad debt deductions are much less onerous. Only the income injection rule applies, and then only where a person outside the family group is involved. Otherwise, there is also a 50% stake test, a control test and a pattern of distribution test that have to be satisfied.

Having an FTE also relaxes the company loss tracing rules, the holding period governing access to franking credits and the application of the trust beneficiary reporting rules.

Keep the diagram handy when confirming who the beneficiaries of a family trust can be, without paying family trust distributions tax.

Trust distributions from a discretionary trust

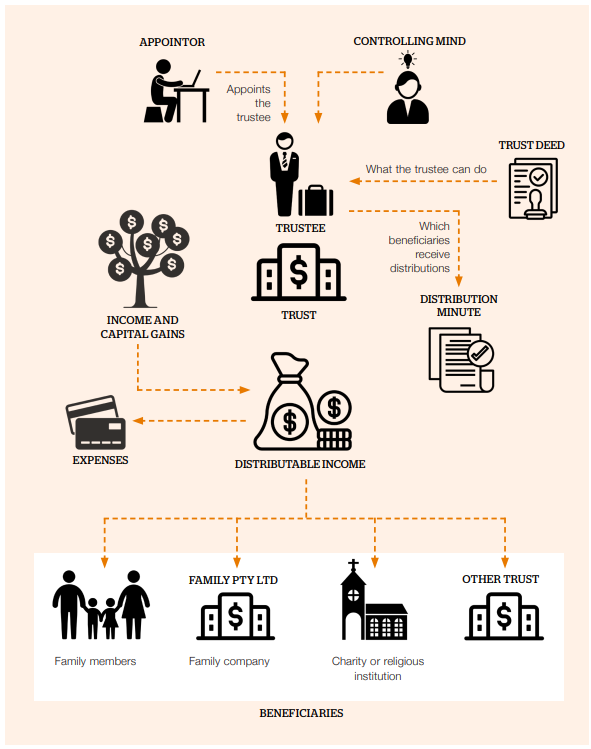

The purpose of a trust is to separate the legal and beneficial ownership of assets. The legal ownership of the asset rests with the trustee. The beneficiaries benefit from the income that flows from the assets.

A trust is not a legal entity. It is best described as a legal “relationship” that is controlled by the trustee of the trust under the terms of the trust deed.

Trustee

The trustee is the controlling mind of the trust. A trustee can be an individual or a number of individuals. A trustee can also be an entity, such as a company. The trustee has a fiduciary duty to administer the trust for the benefit of the beneficiaries.

A fiduciary relationship is one of the utmost good faith. The trustee must only act in accordance with the trust deed and relevant trust legislation. The trustee is the legal owner of the assets of the trust, but not the beneficial owner.

A trust is a discretionary trust when the trustee has the absolute discretion as to how the income and capital of the trust is distributed to beneficiaries.

Trust deed

The trust deed is a legal document signed by the creator of the trust, called the settlor. It gives instructions to the trustee as to how the trust is to be administered and what activities it can engage in. It also names and specifies the beneficiaries of the trust. The trust deed is a very important document.

Appointor

The appointor(s) are the individuals that appoint the trustee and can change the trustee. It is important that a trust always has a living appointor.

Distribution minute

In most cases, by 30 June each year, the trustee must determine the distributable income of the trust. The trustee must then decide how the distributable income of the trust is to be distributed among the beneficiaries. This includes the amount of the distributions and also the type of distributions (e.g. capital gains and franked distributions).

Beneficiaries

The beneficiaries are those that may benefit from the income and capital of the trust. Usually, there are primary beneficiaries defined in the trust deed and most other beneficiaries will be related or connected to the primary beneficiaries. Beneficiaries can be entities and do not have to be human beings.

Taxation

Income distributed to adult beneficiaries and beneficiaries that are entities are taxed to those beneficiaries. The trustee is taxed on income distributed to child beneficiaries. The trustee is also taxed, often at the top marginal tax rate, if there is income of the trust that has not been distributed to a beneficiary.

Note that the taxation of trust income can be a complex matter, and usually requires professional advice. See the diagram on the following page.

Where do reward programs stand in regard to tax?

Many businesses and organisations offer their customers loyalty award-based incentive programs. They are designed to reward customers for purchasing or using a company’s goods and services (or sometimes affiliated businesses).

The ATO deems that flight rewards received under consumer loyalty programs are generally not taxable.

However, it also notes that FBT may apply where:

■ the employer and the employee have a family relationship and the flight reward is received in connection with the employment, or

■ a flight reward is provided to an employee, or the employee’s associate, under an “arrangement” for the purposes of FBT that results from business expenditure.

The flight rewards might also be subject to income tax if these are received by an individual who:

■ renders a service on the basis that an entitlement to a flight reward will arise

■ receives the flight reward as a result of business expenditure, or

■ where the activities associated with obtaining the reward amount in themselves to a business activity.

As a result of one particular court case, the ATO accepted that flight rewards received by employees in their personal capacities in respect of expenditure paid by their employer are not assessable income.

The tax treatment is based on the court’s decision that flight rewards received by an individual who provides services, or who has received the reward because of “business expenditure”, are not assessable as the reward arises from the personal (that is, non-service/non-business) contractual relationship with the rewards program administrator.

The case in question dealt with the situation where an employee, who had accumulated points as a result of travel on behalf of her employer, converted those points into airline tickets for her parents (the points were not convertible to cash). The court held that the points related to her membership of the program, and there was no contractual relationship between the employer and the program administrator.

Consequently it was irrelevant that the employer had paid for the cost of the original travel.

An exception to this tax treatment, however, would be where a person renders a service on the basis that there will be an entitlement to a flight reward — that is, a person enters into a service contract understanding they will receive rewards.

So while the ATO provides that rewards received under consumer loyalty programs arising from “private expenditure” are not subject to tax, it is however on the lookout for circumstances where:

■ the arrangement is so contrived and artificial that it has no commercial purpose other than to allow the recipient to receive the rewards

■ the nature of the arrangements suggests that the rewards are a substitute for income which would otherwise be earned, and

■ the points accumulated exceed 250,000 points per annum.